For what reasons should you prioritise risk management for startups? Well, whether it’s software development or any other, all businesses operate in a highly uncertain environment punctuated by various risks in today’s technologically advanced world. Managing these risks while keeping your business afloat is one of the most important tasks you must complete as a startup business owner. Your startup will run smoothly and adhere to legal and regulatory requirements if you identify and manage the risks that it faces.

It is crucial to keep your attention on your company’s advantages as it grows. You must, however, also reduce risks. This entails planning your response and making adjustments as necessary when curveballs from the business world are thrown your way.

The success of your business is future-proofed by proactive risk management, which also increases revenue and draws in new customers. Here are some tips for controlling the risks that your startup may face.

1. Take cyber safety seriously

Cybercrime rates are higher than ever before. Keep in mind that most cyberattacks target businesses rather than individuals. That is why companies are at risk of data hacks. In most cases, hackers are increasingly targeting cloud-based systems because that’s where most organizations are storing their data.

You need to take precautions to avoid being their target

So, have a policy against cybercrime as a part of your risk management strategy. Make sure to take steps to make your employees aware of the importance of creating safe passwords, the protection of business information, and also how they can safely use the web.

2. Risk Management or Startups: Take steps to avoid financial risks

Startups are subject to many financial risks, including shifting stock prices, fluctuating exchange rates, high tax demands, shifting stock prices, and issues with managing cash flow.

Financial risk management needs to be taken seriously by businesses. This entails handling financial risk issues for your business. You should track your cash flows as a startup business owner in addition to knowing how much money you have set aside in case of unforeseen circumstances.

3. Manage Your Legal and Regulatory Obligations

Laws and regulations that govern businesses in your industry can change in an instant. Failure to comply with the changes may result in lawsuits, among other problems. Regulatory risks are usually caused by changes in regulations and laws. If you do not keep up with these changes, you may be caught off guard when they are implemented by the appropriate agencies.

Avoid ignoring such changes because they can increase your operational costs as well as reduce the attractiveness of an investment. Because your company is still in its early stages, you will undoubtedly want to attract investors while also avoiding criminal charges and large fines. Being aware of regulatory changes allows you to manage your regulatory risks.

4. Manage your startup’s reputation

The reputation of your startup is very important in determining its longevity in business. To scale, you must maintain a positive image that will attract investors while also assisting you in building a solid client base. You will come across situations that endanger your company’s reputation at some point. This is normal, but more importantly, you should know how to handle such situations without jeopardizing your company’s reputation.

The definition of risks that can harm a company’s reputation is part of reputational risk management. These risks frequently relate to your company’s code of ethics, safety and security measures, and long-term viability. Ignoring such risks can result in business failure and even bankruptcy.

5. Be more adaptable

Long-term commitments should be avoided during the early stages of your startup. Clients will inevitably change as you grow. Similarly, your scope of operations may expand or contract. When first starting out, make your operational setup as adaptable as possible. This will make it easier for you to make quick adjustments when necessary. Making long-term commitments may drain your finances while also limiting your operations when business begins to pick up.

Risk management determines whether your startup grows or fails. When starting a business, you should include a risk management strategy in your business plan. Similarly, you should keep in mind that some risks are beneficial. Of course, negative risks are undesirable. But positive risks can be the key to gaining new opportunities for your startup. This is where risk management plays a major role. Proper risk management helps to balance positive risks while providing appropriate solutions for negative ones.

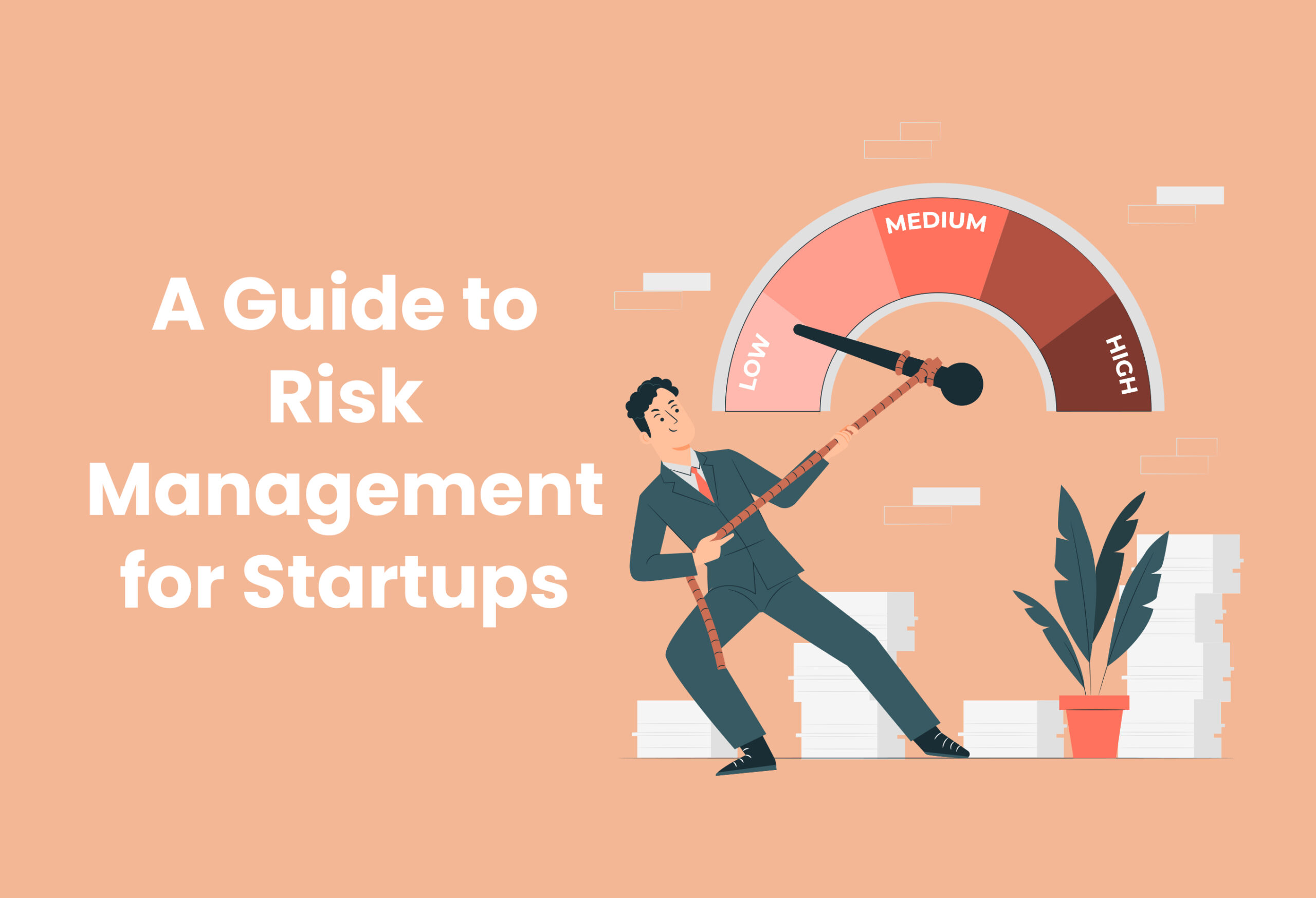

6. Create a good risk management plan

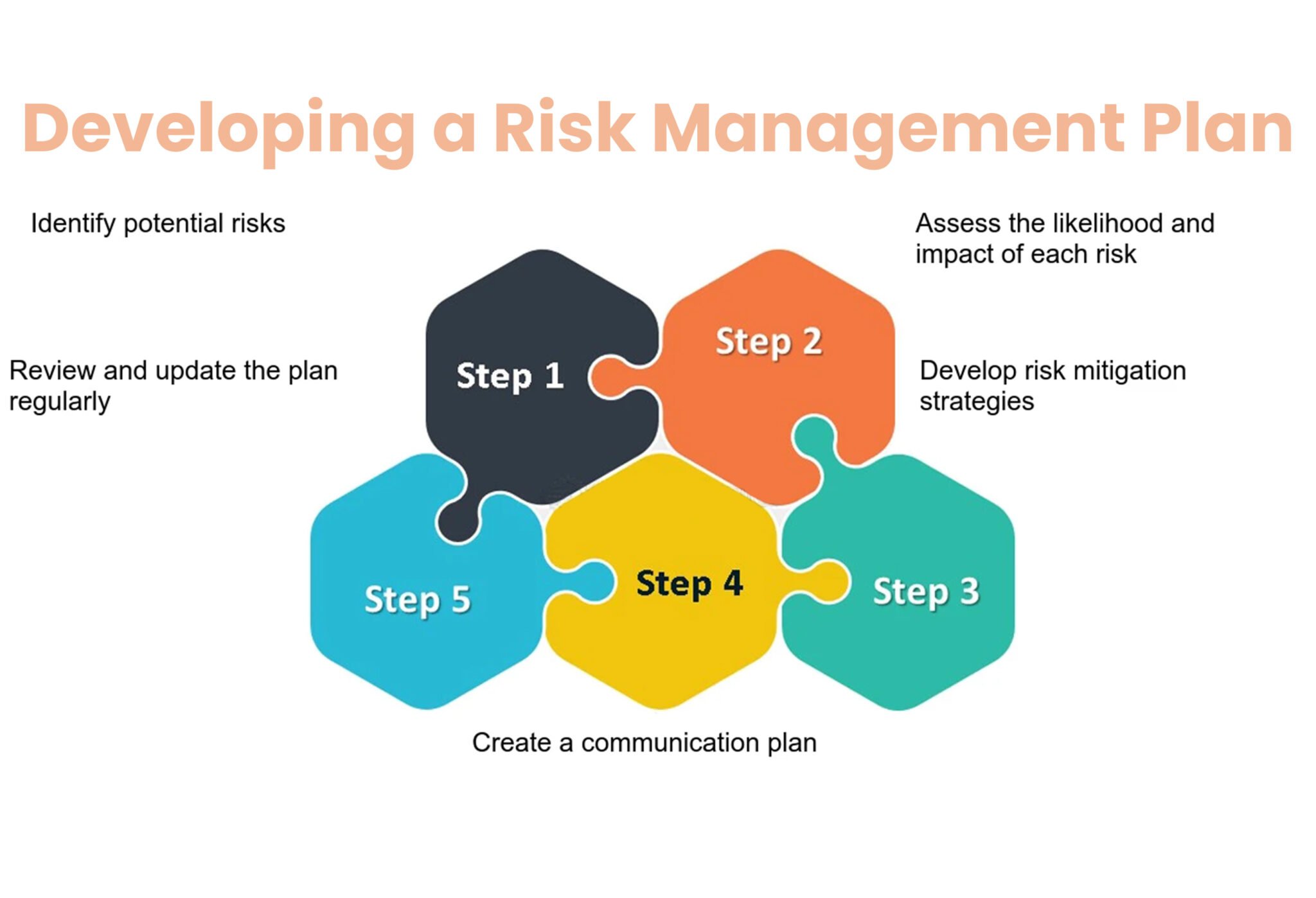

This is one of the key elements of risk management for startups. Without a risk management plan, no startup can succeed in today’s competitive business world. The uncertainty that you may face may appear frightening. To reduce the impact of risks, you must implement a risk management strategy tailored to the specific risks that the company faces.

A solid risk management strategy assists you in resolving potential problems. This paves the way for your company’s long-term success. The monitoring and assessment stage must be included because risk management is an active and complex business commitment. You’ll be able to do that in the future to get rid of that kind of risk.

7. Set up your business in a business-friendly environment

Political unrest, shoddy judicial systems, high levels of corruption, and oppressive bureaucracies can all be found in some nations or regions. When you start a business in such a setting, you end up spending the majority of your time on activities that are ineffective and don’t actually add value to your company.

The best alternative is to establish your company in a business-friendly jurisdiction with low taxes, political stability, the rule of law, protection of intellectual property, and no corruption.

8. Diversify your business

Most small business startups tend to face the risk of relying on a single or a small set of factors for any aspect of their business. When your business is financially dependent on one or two major clients, it is vulnerable if those clients fail or experience other problems.

For instance, if you extend credit to a single, sizable client for an additional 80 days after receiving revenue from them, if, for some reason, they are unable to pay you, You’re helpless.

We recommend always having a backup plan if most of your customers come from just one marketing channel and that channel fails.

Wrapping Up

There you have it! Now you know all about risk management for startups. As a startup business, you have to focus on proper risk management at all times. The strategies you learned through this article can help you manage the risks of your business.