As a foreign startup founder, you would want to learn how foreign businesses can raise capital in the United States. Taking the steps we mention in this post will make it possible. Through this post, we’ll be discussing all about raising US funds as an international startup. So, without further ado, let’s get to it.

Raising US funds as an international startup—a question to oneself

Before anything, you have to have a clear answer to one important question. That is, “Why do I want to raise money from American investors?” In general, international founders mention they want to raise funds because of one or more of the following three factors:

1. Access to capital

It is still true that Silicon Valley has more investors willing to invest at higher valuations than any other place in the world, despite recent changes in access to capital in some markets like China and Southeast Asia. Because they want to connect with those investors, many founders travel to the United States.

2. Help grow your company

The collective expertise of Silicon Valley on how to create a world-class technology company is another important resource to have access to. You can advance more quickly by talking to experts who have done it before, learning from them, and enlisting their support through investments.

3. Unicorn aspirations

For anyone who doesn’t know, Unicorn is a term popularized in the venture capital industry that’s used to describe a technological startup with a $1 billion market value. There are more opportunities abroad as mobile usage has increased elsewhere. Online sales of goods and services are rapidly growing. The global opportunity has been made clear by businesses like Alibaba, JD, Didi, and Gojek, and there is growing interest in discovering and funding potential unicorns abroad. As more investors look for returns in global technology markets, there has never been a better time to enlist the support of American investors and entrepreneurs for your international startup.

Raising US Funding as an International Startup – Step-By-Step

First Step: Establish a legal structure in the United States

Some investors require international companies to sell to a company based in the United States. What exactly is a flip? It is the process of forming a Delaware C corporation and exchanging shares with your foreign entity. You effectively have a US entity that can be invested in by investors in the US and around the world, avoiding additional complexities such as international tax reporting requirements.

If you decide to flip, think about the tax repercussions, which entity owns the intellectual property, and how you structure business contracts between the entities. Obtain appropriate legal counsel to assist you in addressing your concerns.

Another thing to think about is starting early. The complexity of flipping increases with the size of your organization and headcount. Doing it as soon as possible can save you money and time in the long run.

Second Step: Achieve your targets

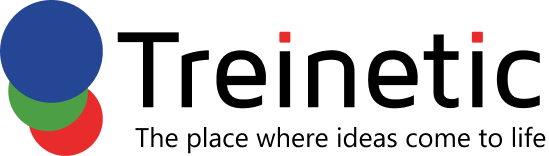

Everyone wants to know what the hack is for raising money, but the real hack is to build something that has a product-market fit and is actually growing well.

Instead of attempting to figure out the fundraising hack, spend 95% of your time talking to customers. Establish what they desire, how to produce it, how to deliver it to them, and how to get their feedback. If you do this, you should be able to iterate on something that grows very well. That is how product-market fit is achieved. By talking to your customers and iterating, you can achieve success. That is what you should devote the majority of your time to.

Ascertain that you have identified a sizable total addressable market (TAM).

It is more difficult to build a large business without this, and raising capital will be more difficult. This is especially important for international founders to demonstrate to US-centric investors. As a result, when pitching your startup, you must present the broadest vision possible. This can include aggregating an entire region or focusing on verticals that investors anticipate will be lucrative, such as transportation or food delivery.

Third Step: Develop a good narrative

Storytelling usually includes three parts, such as:

-

- Things work in a certain way.

-

- Something takes place.

-

- Things work differently from then on.

What does this have to do with fundraising? Well, you can incorporate this too. You should always structure your narrative and conversations with investors around these three acts.

Tell them about the market: where it is, what the problem is, and why it is so large.

Highlight the tipping point: Perhaps everyone now has a cell phone. Perhaps everyone now has a credit card. Perhaps people now buy things online.

Show a new way: how your product solves this problem, how much traction you have, and how you plan to reshape the world.

It is necessary to have a polished narrative that leads listeners through a story arc. Experiment with different narratives until you find one that truly speaks to you. with people other than investors, such as fellow entrepreneurs and industry professionals. When they get excited about it, you know the narrative is working.

4th Step: Determine the round’s terms

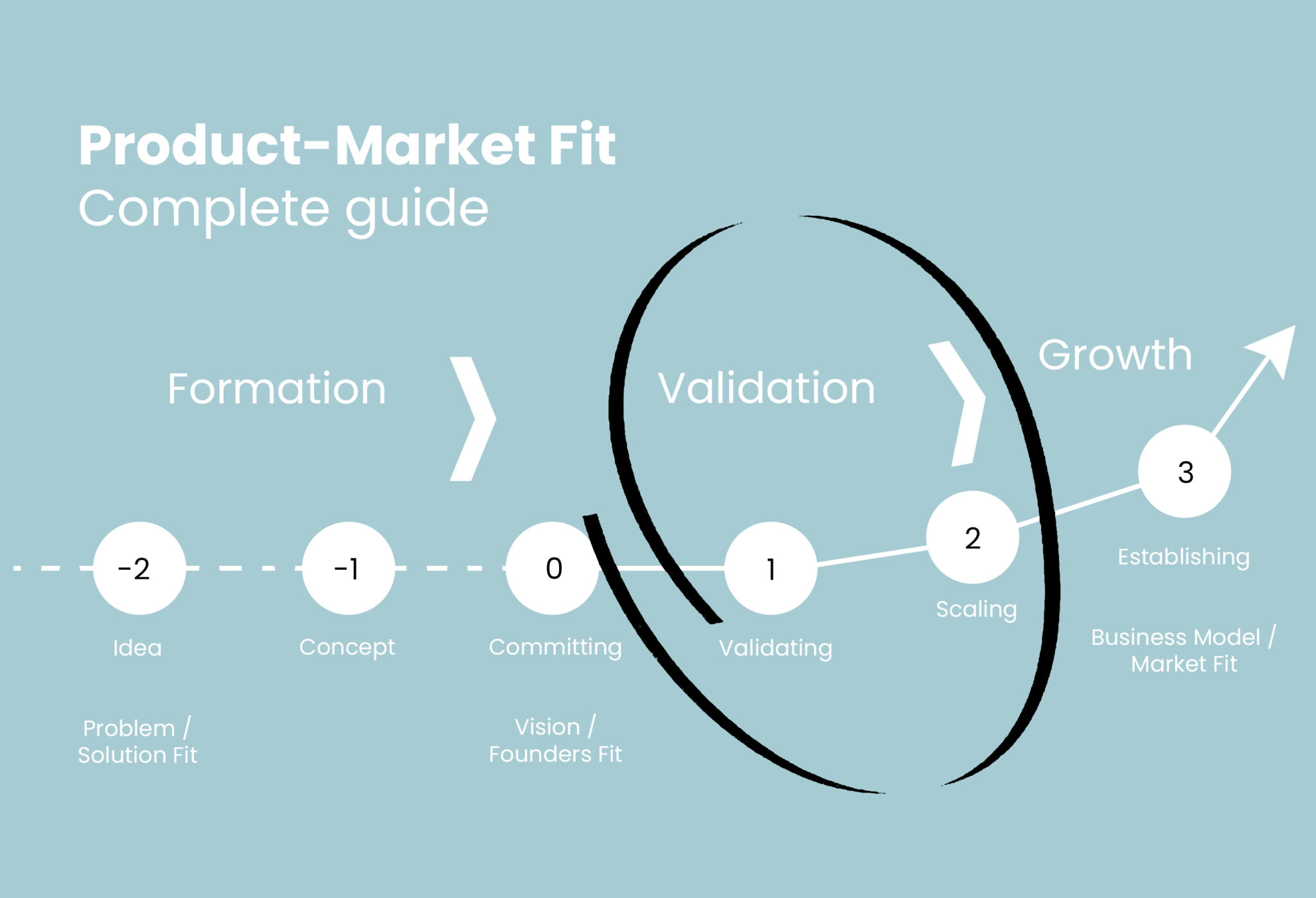

The pre-revenue valuation is based more on potential than results. “How do we determine our valuation?” people frequently inquire. The answer is that it is entirely fictitious. Early-stage company valuation is linked to potential. It’s completely unrelated to revenue. Early-stage companies should stop worrying about calculating valuation based on revenue and instead focus on figuring out how to pitch a big story.

How much money do you raise? You’ll need enough money to last you 18 to 24 months. That’s long enough to set some compelling goals and build a healthy buffer. There is a wealth of information available on raising funds, so do your homework. Although many businesses believe that their valuation must be determined by certain financial metrics, this is not always how it works.

5th Step: Get in front of the right investors

Choose the investors to whom you want to pitch. By focusing on the investors who are most likely to be interested, you can save both your time and the time of potential investors. If you run a biotech business, you want to raise capital from investors in the field. Find people who are receptive to the idea of investing in foreign companies if you run an international business. Make research. On CrunchBase or AngelList (now WellFound), look at what people have invested in and decide specifically who you want to talk to.

You should include a brief, succinct summary of why you’re a compelling investment in your introduction. In seven to eight sentences, go through each of those three narrative arcs.

6th Step: Go into meetings prepared

Be ready for the meetings once you have the introductions.

1. Steer clear of assuming

You must be able to describe your company and industry to someone of average intelligence without providing any background information. Make it brief and uncomplicated. Describe your pitch to them without using any industry abbreviations. Don’t give your audience a reason to leave the discussion. Your task is to maintain their interest. You achieve this by guiding them through a potent narrative while keeping things straightforward.

2. Be familiar with the meeting

You need to plan for the meeting by doing your research on the types of investors. Note that usually angel investors are okay with writing a check immediately after the meeting. On the other hand, venture investors will most likely request that you follow their process. Later on, they would advance you to a meeting with several partners, then perhaps with other partners, and finally perhaps to a meeting with all partners.

3. Be sincere

Being genuine is a potent way to establish a connection. Be truthful when describing the positive aspects of your company. Instead of making up an answer, you could be honest about the things you don’t know. However, it’s better if you truly understand the metrics and numbers, so make an effort to become well-versed in them. It also demonstrates that you’re more likely to manage your company more effectively.

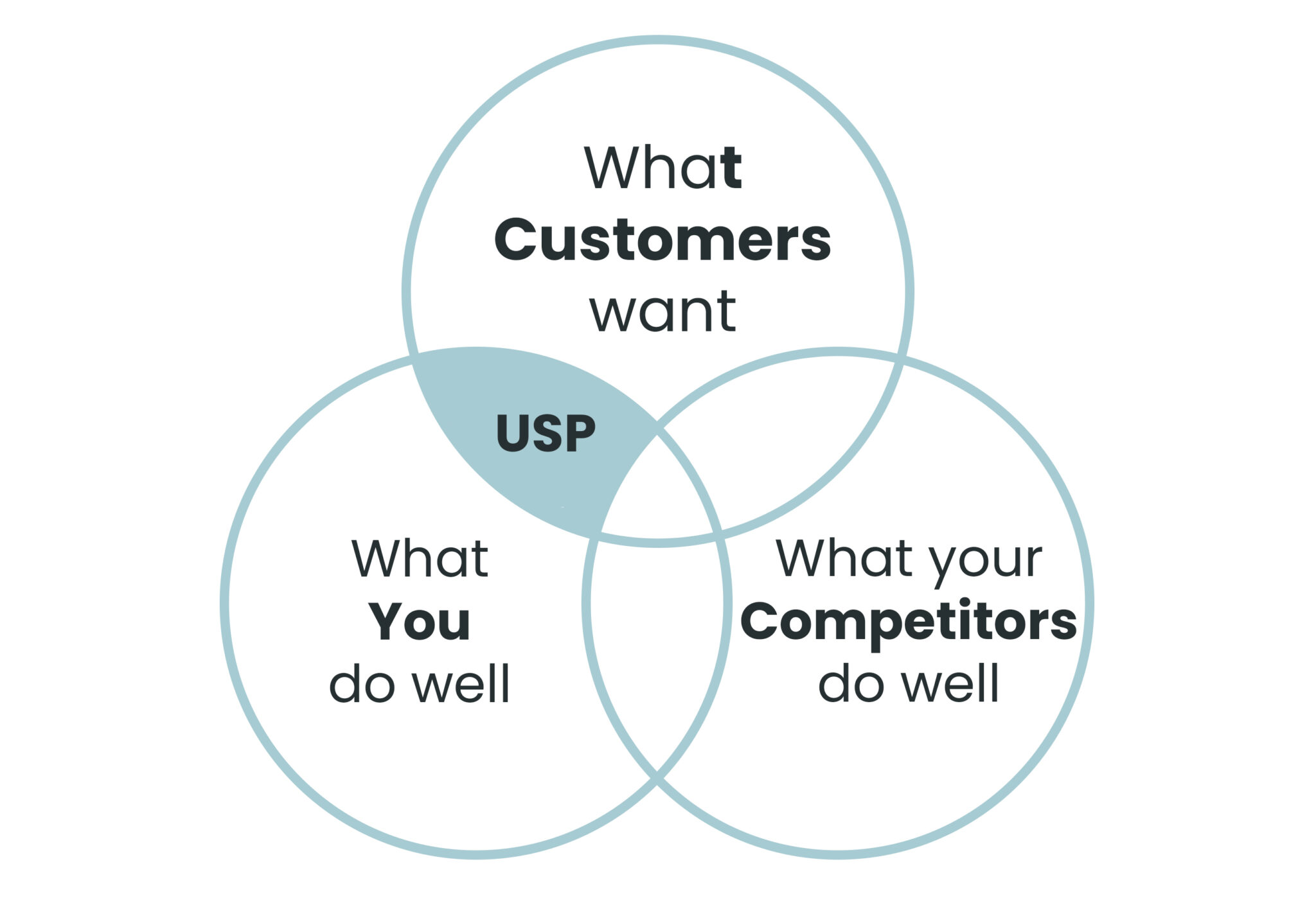

4. Recognize your USP

What is your company’s unique point? How do you excel? Include your USP (unique selling point) by weaving it into the narrative. Make sure you hit on the most appealing aspect of your company by understanding it.

7th Step: Seal the Deal

Let’s say you had a great conversation. They were engaged. They asked you questions. What’s next? Give the process strict deadlines to advance the conversation. Inquire about their interest or the next steps.

Setting a deadline for your fundraising can help add some pressure. But don’t fall into the trap of doing it with no leverage. It’s appropriate to say something like, “I’ll be speaking with investors over the course of the next two weeks with the intention of closing the seed round.” Silicon Valley was built on the belief that businesspeople and investors would keep their promises. Stick to the terms you’ve agreed to, even if it was just over email or a handshake; even if the next day you learn you can get a better deal, you need to do it for your reputation.

Wrapping up

There you go! Now you know all about raising US funding as an international startup. It may seem difficult to raise funds as a foreign startup. However, by following this guide and taking the steps we discussed, you would be able to raise US funding for your startup. You will also benefit from reading our post: How to Set Up a Startup Business in the US.